Insights/FAQ

A checklist of Malaysia property purchasing taxes & expenses

As a foreigner purchasing a Malaysia property, there are additional expenses on top of the initial down payment in terms of tax and recurring yearly expenses. Our team has compiled the checklist below for your easy reference.

Taxes (One-off)

1. Memorandum of Transfer (MOT) Fee

The Memorandum of Transfer (MOT) fee is a one-off tax payable to the government upon completion date of your property purchase. The MOT is a legal document used to transfer the property’s ownership from the seller to the new owner.

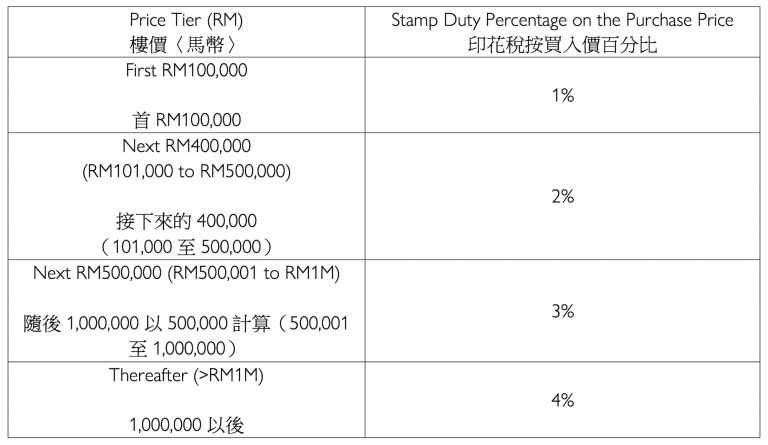

Its stamp duty rate is calculated on a tiered basis:

Here is a sample MOT stamp duty calculation for a MYR1.5M property:

(First MYR100,000 X 1%) + (Next MYR400,000 X 2%) + (The following amount up to MYR1M X 3%) + (Balance amount greater than MYR1M x 4%)

= (MYR100,000 x 1%) + (MYR400,000 x 2%) + (MYR500,000 x 3%) + (MYR500,000 x 4%)

= MYR1000 + MYR8000 + MYR15,000 + MYR20,000

= MYR44,000.-

Or an even simpler way to calculate the MOT fee:

a) MYR24,000.- on the first MYR1M of the purchase price

b) Plus 4% on the balance amount exceeding MYR1,000,000 MYR24,000 + 4% x MYR500,000 = MYR44,000.-

2. Real Property Gain Tax (RPGT)

The RPGT is a tax payable to the government on the profit generated when selling your property in the future. It chargeable on the below basis:

- Should you sell the property after 5 years from the date of purchasing*, capital gain tax is payable on 10% of the profit.

- Should you sell the property within 5 years from purchasing*, capital gain tax is payable on 30% of the profit.

*Note: the date of purchasing is equivalent to the date of signing the Sale & Purchase Agreement. This rule is particularly advantageous if you are purchasing an off-plan development as the 5 year period begins counting prior to when the property is built and delivered by the developer.

Yearly Homeownership Expenses

1. Service Charge (equivalent to the building management fee)

The service charge is a management fee payable on a monthly basis for building maintenance, repairs and upgrades. The service charge is inclusive of a sinking fund, which is a pooled payment between owners to be utilised for future larger scale building repairs or upkeep. The chargeable service charge is dependent on the fee set by your particular property’s building management company.

2. Quit Rent

The Quit Rent is a form of land tax collected by the state government’s Land Office. The exact amount is based on the state government’s assessment. The Quit Rent amount is typically less than MYR100 per year.

3. Assessment Rates

This is also a land tax collected by local councils to develop and maintain infrastructure and services, such as road lighting, cleaning, and collecting of municipal wastes. The exact amount will be confirmed by the local council after the Certificate of Completion and Compliance (building completion) is released. The amount depends on the properties’ annual rent value which varies according to the size of the unit. The payment will be billed twice a year. The actual Assessment Rate amount varies from state to state, but a guideline figure for Malaysia is 4% of the annual rental value of your residential property.

4. Fire Insurance

Under the Strata Titles Act, it is compulsory for the building management office to purchase fire insurance for the whole building. As an individual unit owner, you are required to pay the building management office his or her respective premium portion.

5. Rental Income Tax

Tax imposed on the profit you make on leasing out your property. For non-Malaysians, a flat rate rental income tax of 28% is charged. Rental income is valued on a net basis such that the net rental income can be reduced by deducting expenses. Expenses include Assessment Tax, Quit Rent, interest on home loan, fire insurance premium, expenses incurred on rent collection, expenses incurred on rent renewal, and expenses on repairs and property maintenance.

6. Property Management

Property management fees for leasing, maintenance work and housekeeping, typically amount to 5-6% of the annual rental fee (subject to the different fee charges by different property management companies)

When purchasing firsthand properties,

some developers will absorb the following fees as part of their sales package:

(subject to the particular developer’s sales package for a particular development)

State Levy

For foreigner’s purchasing properties in: The state levy is payable within 30 days from the date of the State Consent Letter issued by the state authority.

For foreigner’s purchasing properties in:

- Penang: the state levy is 3% of the property price

- Melaka – the state levy is 2% of the property price

- Johor: the state levy is 2% of the property price

Penang, Melaka, and Johor are the only states that impose state levies.

State Consent Fee

Under the National Land Code 1965 (“Code”), a person may sell or dispose of his property to a foreign national only after the State Consent has been obtained.

If a foreign national wishes to purchase a residential property in Malaysia, he must therefore make an application to the State Authority to obtain the State Consent before he completes the transaction.

If this is not complied with, the sale or disposal can be rendered null and void. It is usually the developer or venor’s responsibility to apply for State Consent. The state consent fee is MYR10,000 for individuals and MYR20, 000 for companies.

Sale & Purchase Agreement Legal Fees, Legal Disbursements

and Loan Stamp Duty and Legal Fees

Sale & Purchase Agreement Legal Fees

- For the first MYR500,000: 1% (Subject to a minimum of RM 500)

- For the subsequent MYR 500,000: 0.8%

- For the subsequent MYR 2,000,000: 0.7%

- For the subsequent MYR 2,000,000: 0.6%

- For the subsequent MYR 2,500,000: 0.5%

Sale & Purchase Agreement Legal Fee Disbursement:

For firsthand properties, the legal fee disbursement is subject to the price quoted by the developer’s legal representative.

Loan Agreement Stamp Duty (For purchasers obtaining mortgages)

0.5% of the total loan

Loan Agreement Legal Fees

- For the first MYR 500,000: 1% (Subject to a minimum of RM 500)

- For the subsequent MYR 500,000: 0.8%

- For the subsequent MYR 2,000,000: 0.7%

- For the subsequent MYR 2,000,000: 0.6%

- For the subsequent MYR 2,500,000: 0.5%

Learn more about our exclusive developments

Penang, Malaysia

Muze at Penang International Commercial City (PICC)

A landmark smart city development

A 43-acre comprehensive mixed-use development with smart city features in the heart of Penang, the “Silicon Valley of the East”.

1,087 - 1,862 sq.ft. / Prices from HK$2M

Kuala Lumpur, Malaysia

YOO8 Serviced by Kempinski

at 8 Conlay

Fully furnished Kuala Lumpur City Centre branded residences with 5-star service by Kempinski Hotels.

A mixed-use development located in the heart of Kuala Lumpur City Centre, Malaysia’s most sought-after neighbourhood.